Money. Profit. Business.

Whether directly or not, everyone has a money or business situation lurking somewhere. Doing business is one of the popular ways to hit the rich status landmark. And when we talk about business, along with it comes major and minor challenges that can grow or bring down any multimillionaire idea.

That is why as a business owner, you need to stay active and thoughtful of every activity going on in your business world. This is me saying welcome to the smart world of financial management!

Irrespective of the business size, whether you’re running a small business or simply want to keep a closer eye on your personal finances, tracking your daily sales and expenses. These are your game-changers.

In this article, we’ll show you just how easy it can be to track sales and expenses even if you are getting those transactions in tons of thousands. There is always a way to monitor and ensure that things are in shape. Let’s get started.

Why Tracking Daily Sales and Expenses Matters

Tracking your daily sales and expenses might seem like a small task, but its impact on your financial well-being is enormous. I’m sure you know that the strength and survival of any business depend on how well you can manage inventory and monitor cash flow. This is where you put your business wisdom to use.

1. Financial Health:

The same way as humans you intermittently visit the doctor’s office to get checkups and attend to health issues is the same way you should regularly (advisably daily) check your sales and expense list. It’s like taking a health checkup for your finances. Daily tracking ensures you’re on the right financial path and it keeps your business in shape.

2. Budgeting:

This practically helps you avoid overspending. When you are not intentional about knowing what comes in and what goes out, there are tendencies to assume you are making all the money in the whole world. But you might be wrong.

Tracking your daily sales and expenses helps you create and stick to budgets, ensuring you don’t overspend in any category. That way you can have a good judge of what your business is worth.

Simple Sales And Expenses Recording Tips

3. Tax Compliance:

Taxation can take different turns depending on your country or state laws. Knowing your actual income can help you cut down on taxes and dodge overcharging in taxes. Another benefit is that you get to have accurate records making tax season a breeze. You’ll have all the necessary information ready.

4. Financial Planning:

Tracking your expenses and sales lets you plan for future expenses, savings, and investments effectively. With this, you can make more informed business decisions, and figure out if you need to cut down expenses or not.

Tools You Can Use To Keep Track Of Your Sales And Expense

Let’s start with the basics. You don’t need to be a math wizard to track your finances. Several tools and software options can make your life easier:

- Spreadsheets: Excel or Google Sheets are perfect for beginners. They’re user-friendly and readily available.

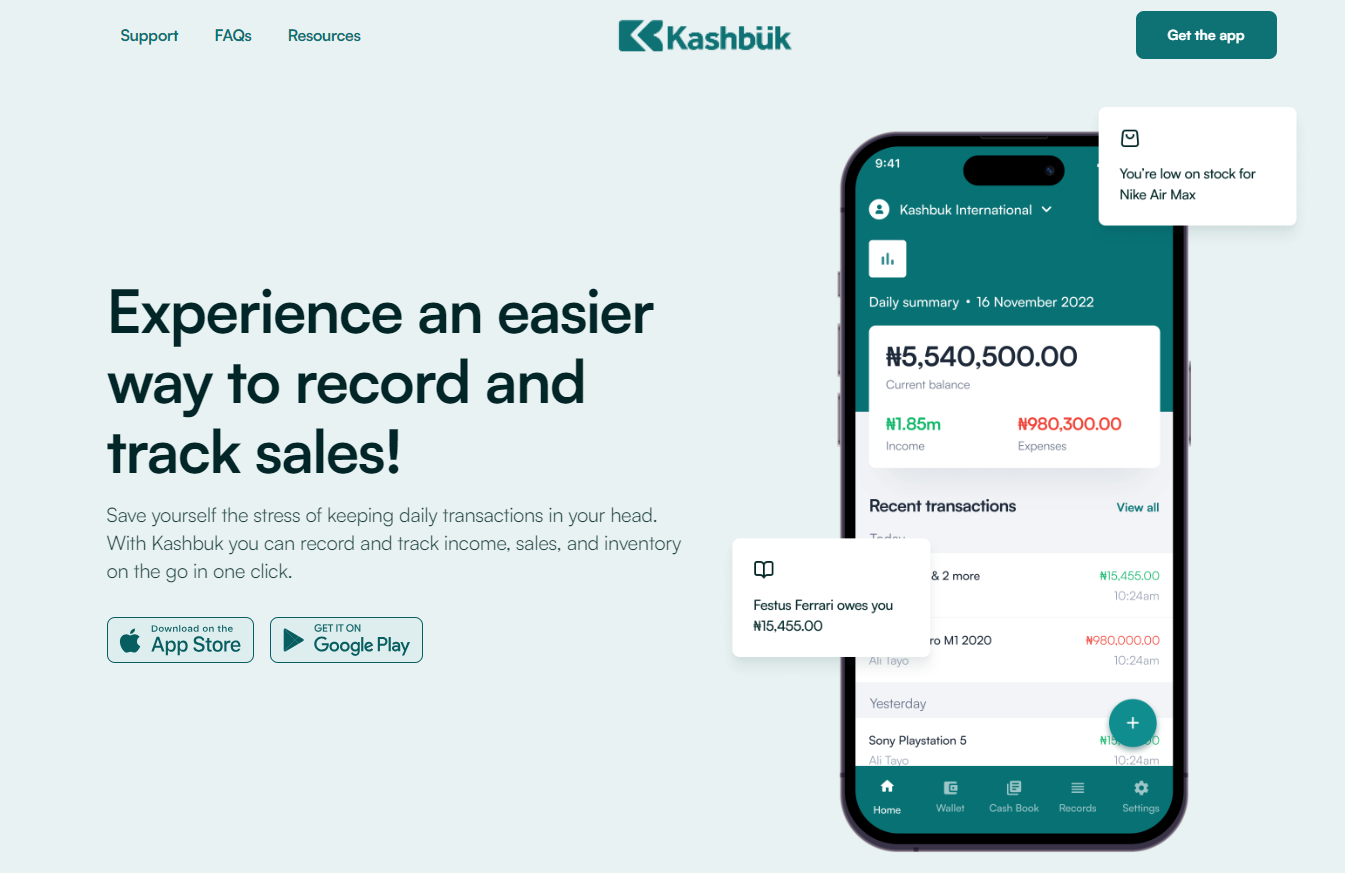

- Bookkeeping Software: Kashbuk is a bookkeeping app tailored to help you keep track of expenses. It is a popular choice for businesses. Kashbuk offers more features for in-depth tracking like reports, and out-of-stock alerts.

- Mobile Apps: If you’re always on the go, consider a mobile app, there is a mobile version of Kashbuk that is easily accessible on Play Store and Apple Store. You get to create a business bank account to make tracking effortless.

Why Do I Need A PoS Terminal For My Business?

Ways To Track Daily Transactions

1. Setting Up a Tracking System

A tracking pattern or system is like setting up your own financial GPS. It makes it easy to locate each transaction instead of having everything lumped together in a document or file. To keep a clean sheet, you can use this format to handle your daily bookkeeping.

- Categorize your income and expenses. Create clear labels for each category.

- Charts your bank accounts. Having a direct business account solely for receiving and carrying out business-related transactions makes reports easier to track.

- Consistency is key. Set aside a specific time each day to input your financial data. It becomes a habit.

2. Daily Sales Tracking

Make it daily. Skipping a daily can make you lose track of little errors that can escalate into major issues. But when such errors are discovered in time, handling them is a lot easier with zero problems. Tracking your daily sales is crucial, especially for businesses.

To make tracking comfortable to do, set up a tracking system. Ensure your sales record includes the date, description of the sale, and amount. Fortunately, if you have incorporated a digital bookkeeping system for your business using bookkeeping apps like Kashbuk, having the mentioned details becomes easier.

Kashbuk helps you take a record of your product description, date, customer details/contact, amount paid, method of payment, and balances where customers make part payments. You can also generate receipts for such transactions in one button click.

3. Daily Expense Tracking

Now, let’s talk expenses. It’s where many budgets go off track. No matter how large a corporation’s profit or earnings are, they are always looking for ways to cut down on expenses. Businesses need to maximize profit at the highest and minimize cost at its lowest. A popular business rule.

Receipts are proof of your expenses and come in handy during tax season. Not during tax seasons alone but also when doing monthly or weekly accounting. A report sheet for your expenses is very necessary. That can help you keep the records properly till they are needed. With Kasbuk, you can download your transaction reports in a minute right from your mobile phone.

Profit Check: How To Assess Your Daily Business Performance

4. Integrate an accounting system

Modern technology has made our lives easier in many ways, and financial tracking is no exception. Integrating digital accounting software for your business makes it a lot easier to track every key performance index which is not limited to tracking sales and expense only.

An accounting software like Kashbuk that helps you record daily transactions can also give you a report sheet of all transactions recorded in a period. It also offers you a business bank and point of sales (PoS) account to receive and send money. This way you don’t have to worry about mixing money from your business with personal money.

5. Monitoring and Analysis

Tracking isn’t just about recording numbers; it’s about making informed decisions. Schedule regular check-ins to review your finances. A weekly or monthly overview keeps you on track. Look for trends in your spending. Are you overspending in a particular category? Adjust your budget accordingly.

Wrap

We hope that this article has now equipped you with easy ways to track your daily sales and expenses. It’s not about being a financial expert; it’s about taking control of your financial future. Start today, and watch your financial confidence soar.