The moment you are in business whether big or small, you need the barest knowledge of accounting to operate. Bookkeeping is the practical life of a business.

To sustain your business, you need to keep records to ascertain how well your business is doing financially and how you can adjust to accelerating growth.

“Bookkeeping has always been necessary, but in the past decade, it’s become even more essential to doing business.”

In this season where having online stores have become the norm, business owners might not see the importance of having a bookkeeping system. Entrepreneurs often overlook the proper bookkeeping practices which at the end of the day leads to financial crises and mismanagement.

To help you keep your business fit, we’ll be exploring some beneficial bookkeeping practices that will help you grow a healthy and successful business.

This blog post will outline essential tips from creating an invoice or quotation, to tracking sales, expenses, debts, and credits.

Practices To Sustain Your Business

1. Monthly transaction evaluation

Both small and big businesses record their daily business transactions. This means that at the end of a week or a month, the bookkeeping record becomes full of multiple transactions for both sales and expenses.

To savor success for your business, you need to take a proper look at your record books on a periodic basis. You can treat the records weekly, bi-weekly, or monthly. This will help you take note of transactions that were omitted or are yet to be updated with payments.

It’s important to perform a periodic check in order to discover any errors and to analyze key accounting performance data such as sales, expenses, debts, and borrowings. Doing this also will help you take the initiative on how to grow and make your business better.

To ensure ease of use and keep track of your business KPIs, Kashbuk allows business owners to download transaction reports for proper evaluation.

How To Keep Accurate Record For SME Businesses

2. Use A Bookkeeping Program

It is the digital age. To record more business success, you need to move with the times.

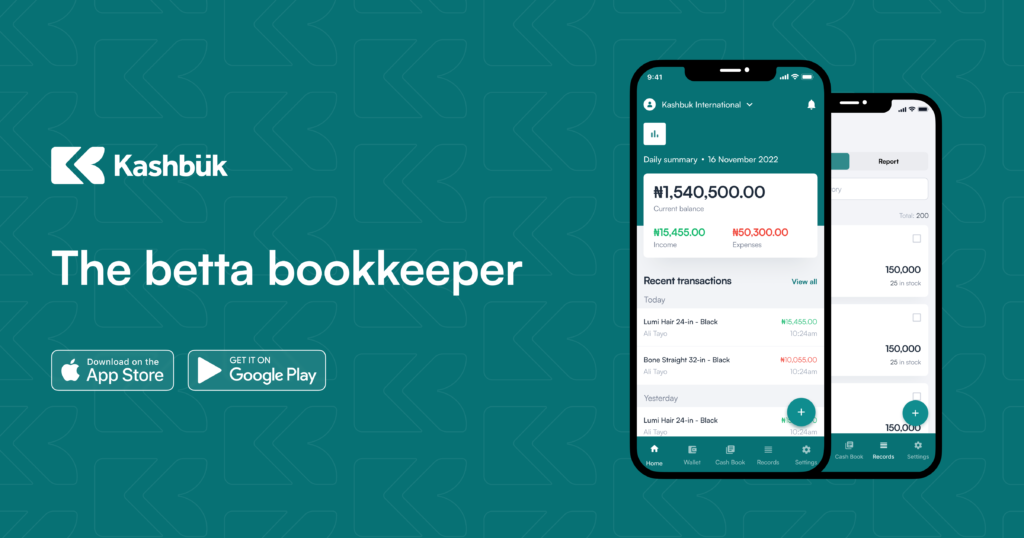

Going digital with your bookkeeping records makes your accounting book clean and available for professional use. Using a bookkeeping application can help you search for transactions from your multiple entries of daily transactions. Aside from that, you can also track every accounting index like sales, expenses, inventory, and the rest.

Bookkeeping programs like Kashbuk can help you determine your daily profits after deducting your expenses from your income. So you do not have to manually calculate your gains.

Before choosing a bookkeeping app, ensure you choose one with features that meet your needs.

3. Using Automated Invoice

When customers request to buy an item, instead of casually telling them the amount payable, you can automate an invoice that shows the amount payable, payment account, customer details, and other charges attached to the purchase. This format can also be used for your receipts as well.

This will help customers take you seriously and also help keep the details of the transaction. This will be very useful for online business owners where customers usually request prices or amounts payable for an item.

For businesses that have physical stores, this also works for customers pre or post-purchase. To create such an invoice, you can use the “create quotation” feature on Kashbuk to facilitate this bookkeeping practice.

4. Reconcile Accounts

This usually happens when you have multiple payment routes for your business. Customers will go for a payment path that best suits them, it now becomes your duty to verify the status of the payment made.

On the Kashbuk app, there is a provision for transactions whose payments are made either by cash or POS. And it is required of the seller to indicate how payment was made for the items bought. We have it like this on Kashbuk so that business owners are able to reconcile their book balances with what they have at hand.

Reconciling your record books helps identify possible discrepancies promptly. This is so that you can correct them to maintain an accurate financial record.

5. Prepare Financial Statements

Bookkeeping is a core part of business accounting. Let’s say the starting point for preparing financial statements in the long run. That is why you need to take recordkeeping seriously so that you don’t fall into an accounting trap when preparing the books.

The income statement account is a common one for business owners whether small, medium, or big corporations. Having your records in shape will give you a smooth ride at this stage. Some of the accounts you might be looking to prepare are the cash flow statement, profit & loss, and balance sheet.

The importance of these accounting statements is to give you an overview of your business’s financial performance for that period. This can be used for taking core decisions for the next financial period.