There are three key things a business owner is always trying to keep in shape.

- Getting Sales

- Retaining Customers

- Managing Finances

The first goal of every business irrespective of size is to gain profit by recording great sales. However, in the race to get sales in the highest number, business owners might lose track of the expenses they incur to the extent that they may be running on a loss without knowing.

That is why bookkeeping is very vital for business owners. Beyond being able to track your sales and expense, you also get to know the overall performance of your business. Whether you are getting as many sales as expected and if your expenses are not beyond your business capacity.

What is bookkeeping for a small business?

The traditional way of recording transactions for a small business can be crude and non-digital. This way can make you easily lose track of some transactions especially when you don’t keep a proper record in a book.

Bookkeeping is the process of recording and tracking business financial transactions. It involves organizing and categorizing business data, such as sales, expenses, invoices debts credits, and payments, into a system that can generate financial statements and reports.

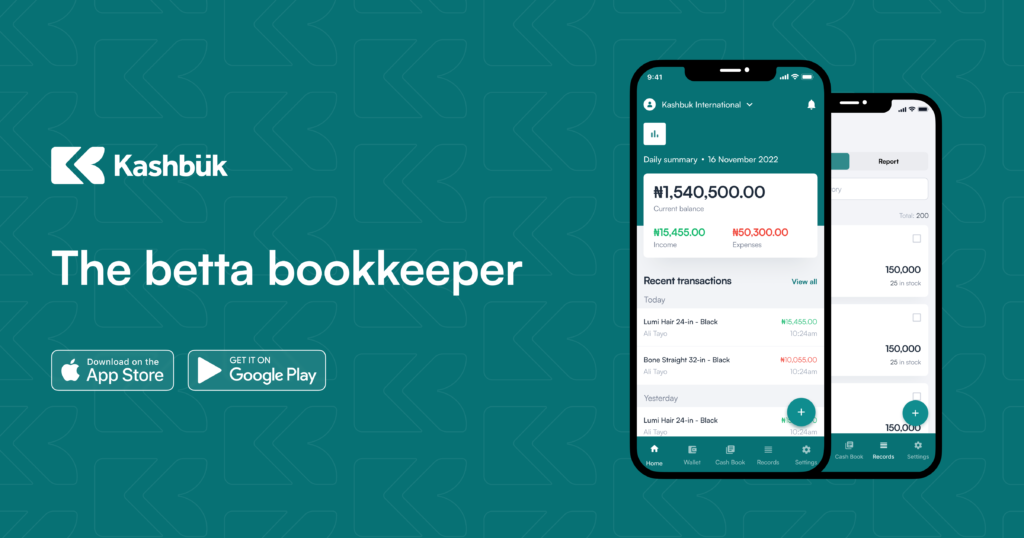

Business owners usually use software programs like Kashbuk to record daily business transactions and maintain accounting records. With this channel, owners can manage accounts payable (credits) and receivable (debts), and prepare accounting reports for the end of a sales period.

Bookkeeping Tips For Small Business Owners

As a business owner, you need to know that bookkeeping is a critical aspect of your business. Having a proper record of your transactions as it provides the foundation for creating accurate financial reports that can be used for decision-making and accounting compliance purposes.

1. Use a bookkeeping system

The traditional way of recording business transactions is to have a ledger or random book used by business owners to keep records of daily transactions.

This method of recording sales, expenses, and other transactions can be strenuous. Sometimes, transactions can be misrecorded or missed. The good news is that the digital age has helped business owners record transactions without having to lose out on records.

Digital bookkeeping apps like Kashbuk gives business owners to record sales, expenses, inventory, and other key transactions. This can save time and prevent errors that happen at the point of entering transaction details.

2. Record Books

Keeping separate record books for different purposes will help keep your account clean.

Having a separate record for expenses, sales, inventory, debts, and credits. Having separate records will save you the stress of going through huge records searching for a transaction.

That is why using a digital bookkeeping app can help you keep your transaction sheets clean and separate. It also saves you time going through ledgers to search for a transaction.

3. Daily update of records

One key practice in bookkeeping is the daily entry of transactions. You need to enter transactions on a daily basis. This way you won’t miss out on some transactions.

That is why Kashbuk allows business owners to enter transactions on daily basis. The bookkeeping mobile app attach’s the current date to the transaction entry.

4. Keep the rule of separate entity

Separate entity is an accounting rule that states that business records should be treated and accounted for separately from owner’s personal finance.

That means you need to keep business business. Mixing up personal spending with business does not make your bookkeeping look good. This might also read wrong statements when you have a third party or an investor requesting to see your records.

To fix that, you can create multiple accounts on Kashbuk that will attend to those needs. One for your business, and another for recording personal finance. This way you don’t muddle up your record system.

5. Update your records

Most small businesses have customers who patronize them and pay in installments. In cases like where you have entries for customers who made part payments or no payments, you need to update the records regularly as the customer pays.

Updating your debtors and creditors book is a good tip for small business owners. This way you get to know what debt you need to recover or what credit you need to make payments for. This helps you keep track of your debts and credits without losing your money to any customer due to omission.